WE’VE ACCOMPLISHED the first step in understanding how the industry of credit has evolved and how it currently plays a major role in every economy around the world, so let’s continue on.

Drilling down another step in the process, it is vital to be educated on how individual credit reports, and ultimately the corresponding credit scores, are examined by creditors and lending organizations around the world to determine the amount of creditworthiness an individual (or business) comprises. Simply put, it is the result of that examination that will ultimately decide if a person or business has the qualifications to receive financing for the goods and/or services they may be seeking.

Let’s start with the basics. A credit report is a record of your financial behavior and performance over time. It consists of categorized information about your credit-related activities and designates how responsibly you have used that particular credit and subsequently, met those financial commitments. This is how an individual’s credit history commences and is later maintained over time by individual creditors, and most importantly, the credit reporting agencies around the world.

The credit reporting industry is a sophisticated network of lenders, creditors, merchants, and other similar sources who furnish credit data on consumers and businesses applying for and using credit. Credit reporting agencies’ main purpose is supplying risk management data to creditors. Equally, lending organizations, such as banks and financing companies are required to manage risk, and credit reporting agencies distribute that information to those needing to asses a particular borrower.

Score Big…and Win!

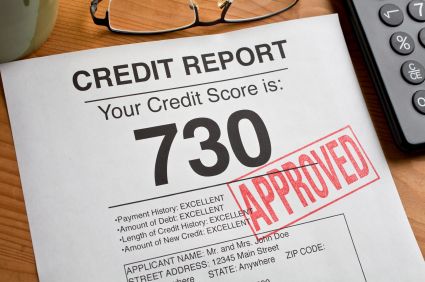

After all of this information is compiled, most credit reporting agencies assign corresponding ratings or scores to the history-packed reports. Those scores are calculated by multiple factors and can be the first thing a creditor views when making decisions on extending credit to the proposed borrower. So, the more you know about how your credit score is calculated, the more straightforward it will be for you to sustain a good one. The key is remembering one thing; the higher your score, the lower the risk you are to a creditor.

Calculating credit scores usually follow roughly the same pattern with every credit reporting agency. These factors can include payment history, amount of debt owed, age of credit, the different mixes of credit, and even recent credit (or credit inquiries). In most cases (and certainly in the US) each of these factors can be weighted. Make sure you are familiar with this process wherever you are seeking credit. For example, in the United States, an individual’s payment history and the amount owed to creditors make up 65% of the credit score. Here are a few examples on what to be mindful of regarding a quality credit score:

- Pay your bills on time: You probably could have guessed this one. Being late on a payment isn’t good for your score. Missing a payment can compound into even more problems. A good rule is to pay early…and pay the bill in full, if possible.

- Keep those credit card balances low: It’s not a good idea to have any balances of significance for any reason on credit cards. This is how financial responsibility is derived…or lost. The amount of debt you have in comparison to your credit limits is known as credit utilization. If you have a balance on a credit card (or more than one), keep the balances low. The higher your credit utilization, the lower your score will be. Keep the utilization of all cards to 30% or less.

- Monitor and manage your overall debt: Even if you have a satisfactory payment history on your debt, too much of it can also hurt your score. Keeping a solid debt-to-credit ratio is crucial in maintaining a solid score.

- Keep old credit cards open: Believe it or not, even when you close a credit card, it can hurt your credit score. If your credit card issuer stops sending monthly updates to the credit bureaus (even if the account has no balance), your score could be compromised. Your credit history with that creditor will also cease. Additionally, if the credit available is suddenly closed on that account, your overall debt-to-credit ratios will be negatively affected.

- Be careful of too many credit inquiries: Every time you apply for new credit your score stands to take a temporary small hit. Also, opening a new credit account can lower your score, because your average credit age is negatively affected. Seek new credit accounts sparingly to avoid a drop in score.

Your Reports and Scores Now Signify the Winds of Change

The manner in which consumers apply for loans (business or personal) has changed dramatically in the last several decades. Do you remember your father or even grandfather ever telling you about how they used to do business with a bank or finance company? I do. The story, when told to me, seemed so simplistic at the time; mostly because it was probably that rudimentary back in the day.

When I was much younger (and well before I ever started my first business), my grandfather explained exactly how he did business with the local bank in his community. He gave details regarding the ease in which he was able to walk into the bank, practically without an appointment, and be given the opportunity to speak directly to the bank manager, the decision-maker for most financial transactions the bank made locally. He illustrated what his relationship with that bank manager was like, too; how it was relaxed and non-hurried. The bank manager, of course, was also a member of the local community.

Because he did all of his banking business there (personal accounts, loans, etc.) the two of them were able to discuss the new proposed loan (or extension of credit in question) with very little paperwork or red tape. The reason was simple; the bank had a personal history with him. They knew his character. They trusted him and my grandfather reciprocated that trust. Incredibly, he told other stories of the bank manager actually stopping by his home on occasion to see how things were going with him. Again, they were both members of the local community.

In short, a quick look at his previous business dealings with the bank, a short discussion, a review of his personal character, and some additional paperwork was about all it took for the deal to get done. And although his transactions may have never been on a major scale, the process of completing the financial transactions were as stress-free as could be imagined. A one-on-one, face-to-face meeting to figure things out was how it used to be done. That was then.

Today, You’re Just a Number

We would all like to think we have connections. Inroads at the bank or any other alternative financial institution are obviously beneficial. However, your biggest ally will always be what’s hidden behind the numbers, or more precisely, your credit scores. In today’s financial arena, credit score management has taken the forefront in significance and in relevance regarding you or your small business being eligible for funding. In fact, it could be said that credit scores have almost become a form of currency in the way they are weighted by the creditors themselves.

In the fast-paced society we live in today, information and data can be transmitted around the world in seconds. We have the ability to acquire loans and financing in other states and even in other countries when the needs arise. Our investigations for financing and credit can be relegated to Internet searches from any corner of the globe. We may never even meet the person giving us a loan or set foot into that lending institution for the transaction either. Reports, scores and other supporting info can be amalgamated in an instant, and creditworthiness can be decided on a computer screen. This is how it’s done today.

Understanding your personal credit reports is where it all begins. Knowing what can and will affect your corresponding scores will be equally as vital. However, this can also be a good thing. Having the ability to empower yourself through education and research, and implementing a huge dose of self-discipline will result in rock-solid credit reporting and scoring information for creditors to evaluate. So, use this new-found information to your advantage and make yourself a perfect candidate for the best interest rates and quick approval for loans, credit and financing for your business.